Key Events – And Potential Catalysts – For Biotech Stocks This Week

After a week that saw mostly strong earnings reports from big pharma companies, an Alzheimer’s conference that moved stocks, and a slew of IPOs of…

After a week that saw mostly strong earnings reports from big pharma companies, an Alzheimer’s conference that moved stocks, and a slew of IPOs of…

Smaller-cap companies have had a good 12 months, and the author of today’s article notes that “the return picture over the trailing three-year period suggests…

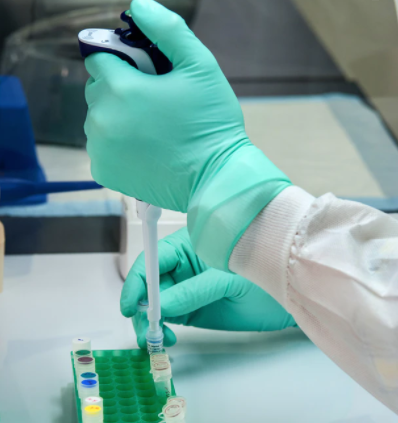

With just a few days remaining in July, the FDA has approved four novel drugs this month, including a treatment for a parasitic “sleeping sickness”…

“All of these companies are working on new drugs that could be worth billions, and successes with them would push their stock prices through the…

While vaccine makers have gotten most of the attention in the biotech sector over the past year, the author of today’s article advises that other…

“This is what it might have been like 25 years ago if some guy had walked up to you and said the internet was going…

As a result of the pandemic, investors have likely become familiar with a number of biotech names over the past year and a half that…

The company discussed in today’s article is a potential leader in a burgeoning field that the author declares “has the potential to revolutionize medicine in…

A lower-risk way to play a “high-octane” healthcare trend is what the nine exchange-traded funds highlighted in today’s article offer. That trend? Biotechnology. And while…

While biotech stocks underperformed the broader market in the first half of the year, some names – particularly those focused on neurodegenerative diseases and cancer…