4 Top Beverage Stocks To Watch After PepsiCos Strong Quarter

Are These The Best Beverage Stocks To Buy Now? An increasing number of analysts in the stock market have been predicting that a recession would…

Are These The Best Beverage Stocks To Buy Now? An increasing number of analysts in the stock market have been predicting that a recession would…

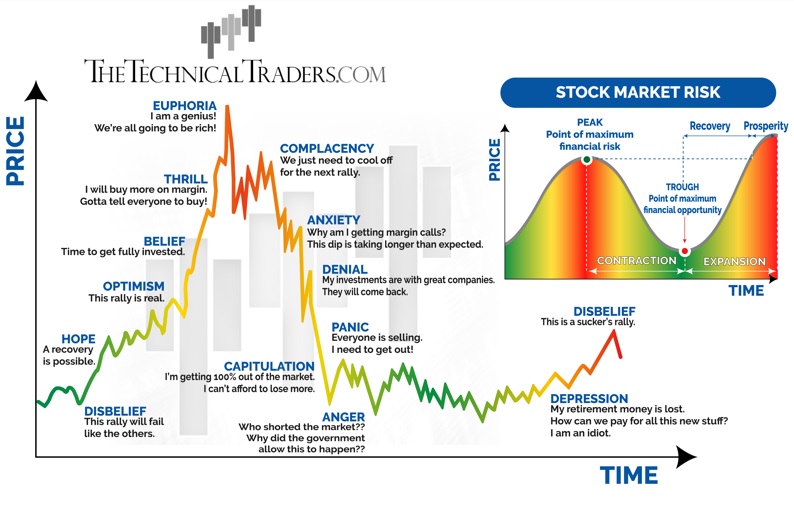

Investors and traders alike are concerned about what investments they should make on behalf of their portfolios and retirement accounts. We, at TheTechnicalTraders.com, continue to…

“With a huge tailwind from the massive stimulus program and the reopening of the economy as spring begins, now is the time to move from…

An intranasal vaccine, an mRNA vaccine, and a T-cell activation vaccine: the three biotech companies discussed in today’s article are approaching the virus that causes…

Product candidates for the treatment of excessive underarm sweating on one hand, and dry eye disease on the other, could help the two stocks highlighted…

What does the most recent data indicate about short interest in the top biotech stocks? The short answer, today’s article notes, is that “short interest…

As the number of those infected with COVID-19 goes up domestically and globally, the competition to develop a vaccine is heating up – and the…

“Buy the Unloved” is a contrarian investment strategy that involves investing equal sums in the three equity categories of the previous year that had the…

From well-known names that have been on investors’ IPO radars for a while now (e.g. Airbnb, Robinhood) to names that are lesser-known (or unheard of)…

As the prices of stocks, bonds and real estate rose over the past decade, gold and other precious metals lagged behind, resulting in the asset…