Toast IPO Preview: Restaurant Revival May Boost This Software Co.

Toast IPO Preview The initial public offering (IPO) market is active again, with many new offerings set to price in the coming days. I want…

Toast IPO Preview The initial public offering (IPO) market is active again, with many new offerings set to price in the coming days. I want…

After a week that saw mostly strong earnings reports from big pharma companies, an Alzheimer’s conference that moved stocks, and a slew of IPOs of…

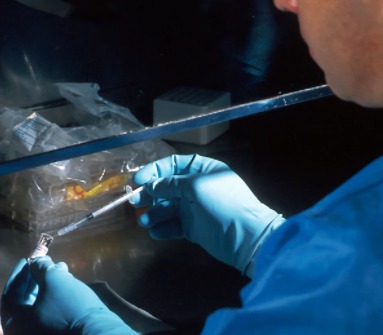

There’s a new type of revolutionary science on the horizon: proteomics. But just what is proteomics – and what do healthcare investors need to know…

After a week in which they came under pressure, what does the week ahead have in store for biotech stocks? Today’s article outlines the key…

The clinical-stage biopharmaceutical company highlighted in today’s article is focused on the development of novel therapies for cardio-metabolic disease, liver disease, ophthalmic disease and cancer…

From well-known names that have been on investors’ IPO radars for a while now (e.g. Airbnb, Robinhood) to names that are lesser-known (or unheard of)…

“’Don’t chase stocks’ is sound advice 95% of the time. But there’s a special kind of stock you absolutely should chase,” declares the author of…

If you missed out on profiting from the first real estate transformation driven by the rise of online shopping (the building out of warehouses and…

It was once the king of the U.S. automakers – until it was pummeled and ended up filing for Chapter 11 bankruptcy. We’re talking about…

Gossamer Bio is a San Diego-based biotech that is readying for an initial public offering – and with a diverse pipeline including potential treatments for…