As Market Trends Continue To Drop – Where Is A Good Place To Invest?

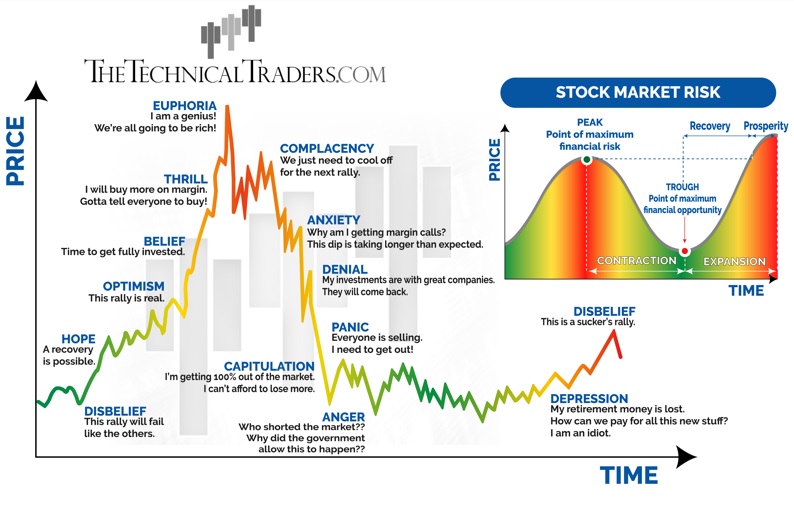

Market trends continue to drop due to investor concerns about geopolitical events, record inflation, rising interest rates, slowing housing, plummeting auto sales, increasing retail inventories,…